The Hong Kong Mortgage Corporation Limited

Mortgage Insurance Programme

Make Home Ownership Easy

Introduction

The Mortgage Insurance Programme ("MIP") was launched by The Hong Kong Mortgage Corporation Limited ("HKMC") in March 1999 for promoting home ownership in Hong Kong. The MIP business has been transferred to and carried out by HKMC Insurance Limited ("HKMCI"), a wholly-owned subsidiary of the HKMC, with effect from 1 May 2018.

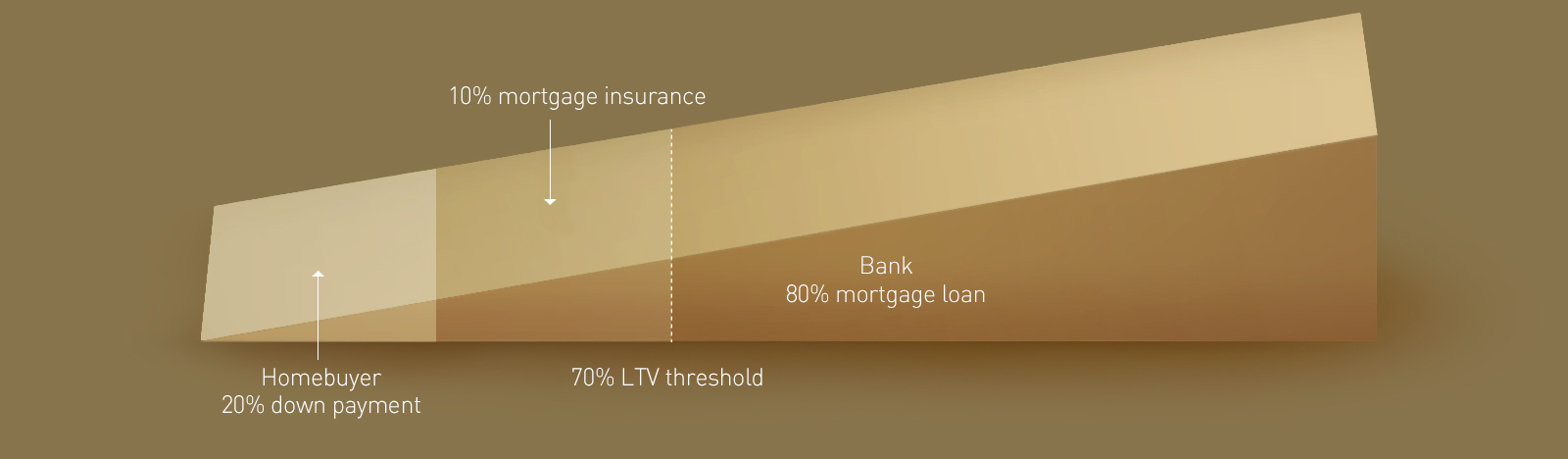

According to the guideline issued by the Hong Kong Monetary Authority, banks have to comply with loan-to-value (“LTV”) requirement on owner-occupied residential mortgage lending. Yet, with the MIP providing mortgage insurance to banks, banks can provide mortgage loans with higher LTV ratio without incurring additional credit risk. As long as an application meets the relevant eligibility criteria (e.g. the maximum property value and the maximum loan amount, etc.), the bank can provide a mortgage loan of up to 80% LTV ratio* under the MIP. In other words, homebuyers may only need to pay 20% of the property price for the down payment, which greatly reduces their down payment burden.

Under the MIP, banks are the mortgage loan providers. The mortgage insurance aims to protect the participating banks from losses, in general, on the portion of the loan over the 70% LTV threshold due to mortgage default by the borrowers. Therefore, in addition to helping the promotion of home ownership, the MIP also contributes to the maintenance of the banking stability.

*For above 80% and upto 90% LTV ratio, only applicable to application with (i) all mortgagors not holding any residential properties in Hong Kong at the time of application and (ii) all applicants being regular salaried persons (please refer to the relevant Insurance Eligibility Criteria)

Example of a 80% LTV loan under the MIP

Note: Banks are the beneficiary of the mortgage insurance policy.

Note: Banks are the beneficiary of the mortgage insurance policy.

The insurance cover shall take effect after the premium is received by the HKMCI.

If required, homebuyers can choose to finance the premium on top of their mortgage loans.

Maximum LTV Ratio

| Property Value# | Maximum LTV Ratio# |

|---|---|

| Up to HK$10 million | 80% or 90%* |

| Above HK$10 million and below HK$11.25 million | 80% or 90%* (subject to a loan cap of HK$9 million) |

| At or above HK$11.25 million and up to HK$15 million | 80% |

| Above HK$15 million and up to HK$17.15 million | 70% - 80% (subject to a loan cap of HK$12 million) |

| Above HK$17.15 million and up to HK$30 million** | 70% |

*Only applicable to application with (i) all mortgagors not holding any residential properties in Hong Kong at the time of application and (ii) all applicants being regular salaried persons (please refer to the relevant Insurance Eligibility Criteria) **Only applicable for provisonal agreements for sale and purchase before 16 October 2024 | |

#For the maximum property value and maximum LTV Ratio of village house, cash-out refinancing, Starter Homes Pilot Project, Starter Homes Project and Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority, please refer to the relevant “Eligibility Criteria for Owner-occupied Residential Properties”

Eligibility Criteria for Owner-occupied Residential Properties

Eligibility Criteria for Owner-occupied Residential Properties (for provisional agreements for sale and purchase executed on or after 16 October 2024)

(a) For Private Residential Properties (including Flat-for-Sale Scheme Secondary Market Scheme "SMS" of the Hong Kong Housing Society)

(i) For Private Residential Properties and SMS other than Village House and Cash-out Refinancing

(1) Eligibility Criteria for 80% Mortgage Insurance Programme (for property value up to HK$6 million)* Download

(2) Eligibility Criteria for 80% Mortgage Insurance Programme (for property value up to HK$17.15 million) Download

(ii) For Village House

(1) Eligibility Criteria for 80% Mortgage Insurance Programme - Village House (for property value up to HK$6 million)*

(2) Eligibility Criteria for 80% Mortgage Insurance Programme - Village House (for property value up to HK$17.15 million)

(iii) For Cash-out Refinancing

Eligibility Criteria for 80% Mortgage Insurance Programme for Cash-out Refinancing Download

(b) For Subsidised Housing Schemes (excluding Flat-for-Sale Scheme Secondary Market Scheme of the Hong Kong Housing Society)

(i) For Starter Homes Pilot Project and Starter Homes Project

Eligibility Criteria for Mortgage Insurance Arrangement for Starter Homes Pilot Project and Starter Homes Project Download

(ii) For Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority

Eligibility Criteria for Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority Download

Notes:

* Only applicable to MIP coverage with:

(i) property value at or below HK$4 million and LTV up to 90%;

(ii) property value above HK$4 million & below HK$4.5 million and loan size up to HK$3.6 million; or

(iii) property value up to HK$6 million and LTV up to 80%.

Eligibility Criteria for Owner-occupied Residential Properties (for provisional agreements for sale and purchase executed before 16 October 2024)

For Private Residential Properties (including Flat-for-Sale Scheme Secondary Market Scheme "SMS" of the Hong Kong Housing Society)

(i) For Private Residential Properties and SMS other than Village House

(1) Eligibility Criteria for 80% Mortgage Insurance Programme (for property value up to HK$6 million)* Download

(2) Eligibility Criteria for 80% Mortgage Insurance Programme (for property value up to HK$17.15 million) Download

(3) Eligibility Criteria for 70% Mortgage Insurance Programme (for property value up to HK$30 million)** Download

(ii) For Village House

(1) Eligibility Criteria for 80% Mortgage Insurance Programme - Village House (for property value up to HK$6 million)*

(2) Eligibility Criteria for 80% Mortgage Insurance Programme - Village House (for property value up to HK$17.15 million)

(3) Eligibility Criteria for 70% Mortgage Insurance Programme - Village House (for property value up to HK$30 million)**

Notes:

* Only applicable to MIP coverage with:

(i) property value at or below HK$4 million and LTV up to 90%;

(ii) property value above HK$4 million & below HK$4.5 million and loan size up to HK$3.6 million; or

(iii) property value up to HK$6 million and LTV up to 80%.

** Only applicable to MIP coverage with:

(i) property value above HK$17.15 million; and

(ii) any applicants who has borrowed or guaranteed outstanding mortgage loans for one or more properties at the time of applying for MIP Cover.

Note on purchase of residential properties under construction

HKMC Insurance Limited wishes to remind potential buyers of residential properties under construction that:

If a buyer of residential property under construction defers mortgage application until the completion of property construction (i.e. by adopting stage payment method), the loan amount that can be secured by that time can possibly be smaller than originally planned due to a change in property valuation. Please pay attention to such risk before making a purchase.

Flat-for-Sale Scheme Secondary Market Scheme (SMS) of the Hong Kong Housing Society (HKHS)

The HKMCI provides MIP coverage for the Flat-for-Sale Scheme (FFSS) and Subsidised Sale Flats Project (SSFP) under the SMS of the HKHS.

Please contact your bank representatives for the list of required documents for the application of MIP under the SMS. Additional documents such as copy of “Certificate of Eligibility to Purchase” for the purchase of flats under the SMS will be required. You may also refer to the HKHS’s website (https://www.hkhs.com/en/application/subsidised-sale-housing) for details of the SMS.

Mortgage Insurance Arrangement for Starter Homes Pilot Project for Hong Kong Residents eResidence and Starter Homes Project for Hong Kong Residents eResidence Tower 3

The HKMCI provides mortgage insurance to enable buyers of the units of the Starter Homes Pilot Project and Starter Homes Project to apply for mortgage loans of up to 90% LTV ratio.

Important Notes:

Potential homebuyers of the Starter Homes Pilot Project and Starter Homes Project who wish to apply for the MIP should review whether they can fulfil the relevant eligibility criteria and consult banks about the mortgage arrangement in advance. For the eligibility criteria and premium rate, please refer to the “Eligibility Criteria for Owner-occupied Residential Properties” and “Premium Rate Sheet”.

Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority

The HKMCI provides mortgage insurance to enable buyers of the subsidised sale flats under the Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority to apply for mortgage loans of up to 95% LTV ratio for Green Form applicants (or up to 90% LTV ratio for White Form applicants) with effect from 1 March 2024.

Important Notes:

Potential homebuyers of the Home Ownership Scheme Secondary Market Scheme of the Hong Kong Housing Authority who wish to apply for the MIP should review whether they can fulfil the relevant eligibility criteria and consult banks about the mortgage arrangement in advance. Income proof must be submitted for verification and self-declarations are not acceptable for assessment of repayment ability. For the eligibility criteria and premium rate, please refer to the “Eligibility Criteria for Owner-occupied Residential Properties” and “Premium Rate Sheet - for Loans under subsidised housing”.

Pre-approval Service

HKMC Insurance Limited offers pre-approval services to the prospective homebuyers who can thus know their eligibility for the MIP before buying a property. Interested homebuyers can submit their applications and the required documents to the HKMCI through the participating banks before signing the Provisional Sales and Purchase Agreement. A pre-approval result is usually available within 5 business days.

Terms & Conditions:

1. Under normal circumstances, the HKMCI will inform the indicative approval result via participating banks within 5 business days after the HKMCI has received all the required documents.

2. The HKMCI reserves the right of final approval of all loan applications. For further details of the terms and requirements of the MIP, please contact any participating banks or call the MIP Hotline (2536 0136).

Important Notes:

1. The availability of this pre-approval service is subject to business arrangement of any participating banks.

2. The validity of an approved pre-approval application lasts for 30 days from the date of approval.

Education and Promotion Activities

To help banks better introduce the HKMCI’s products to their clients and to make the operation flow between banks and the HKMCI smoother, different training courses are organised by the HKMCI for the frontline bank staff from time to time. These can effectively help the frontline bank staff better understand the HKMCI’s programmes, and update them with any new developments.

Enquiry

If you have any enquiry, please contact any participating bank or the HKMCI for more information.

Programme Hotline : 2536 0136

Programme Enquiry : [email protected]