The Hong Kong Mortgage Corporation Limited

ILBS Overview

To further The Hong Kong Mortgage Corporation’s (HKMC) mandate in developing the local debt capital market, the Infrastructure Financing and Securitisation (IFS) business acquires and securitises infrastructure loans and other financial assets (Infra Debt Obligations) to support the distribution of Infrastructure Loan Backed Securities (ILBS) to institutional investors in the capital markets.

To consolidate Hong Kong’s position as an infrastructure financing hub and facilitate infrastructure investment and financing flow, IFS closely collaborates with industry players and promote infrastructure financing and ILBS to investors. IFS aims to support both the global and local infrastructure financing market in becoming more vibrant and diversified, and also facilitates the inflow of market capital to infrastructure projects.

ILBS Issuances:

|

|

|

ILBS Structure

The ILBS securitisation is backed by a portfolio of Infra Debt Obligations spread across various industries, regions, projects and obligors.

ILBS aims to offer institutional investors an ability to obtain exposure to Infra Debt Obligations through various tranches of notes that are externally rated by an internationally recognised rating agency.

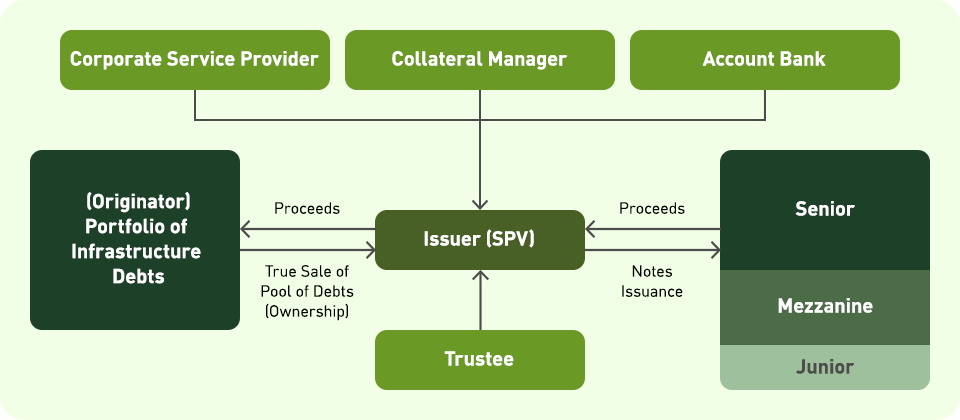

Typically, the ILBS structure is as follows:

Credit enhancement is generally provided through subordination and excess income from the Infra Debt Obligations.

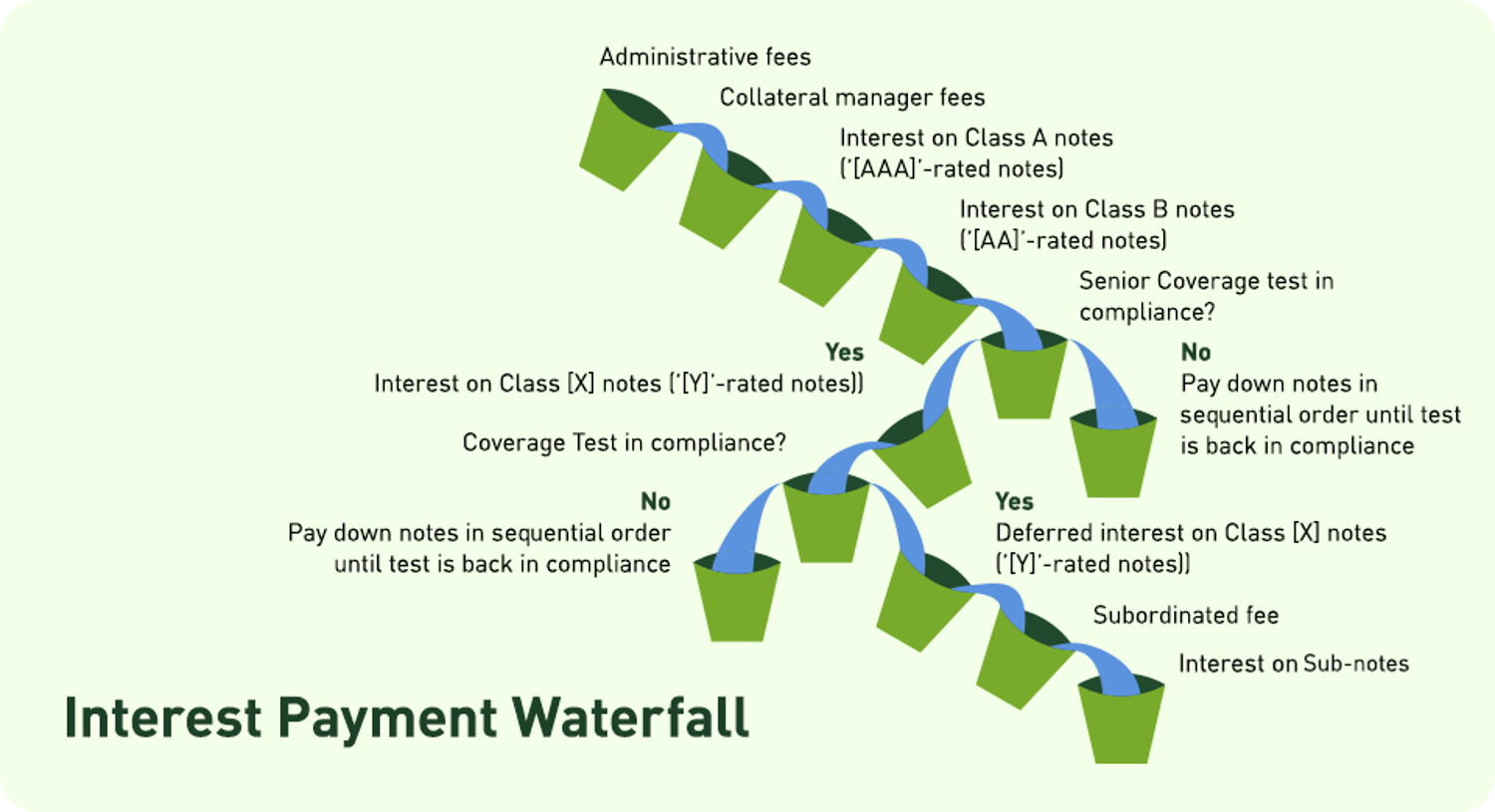

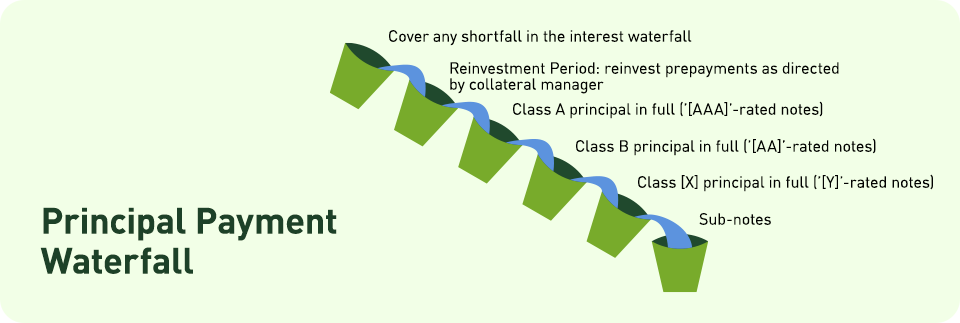

Any principal and interests from the Infra Debt Obligations is distributed via a waterfall structure.

The interest waterfall uses interest received from the Infra Debt Obligations to pay interest on the notes (sequentially depending on seniority) as shown by the follow diagram. When a coverage test fails, interest proceeds are diverted to pay down the principal of ILBS.

The principal waterfall uses principal and potential recoveries from the Infra Debt Obligations to either invest in new assets (during the reinvestment period) or pay down the principal of ILBS (post-reinvestment period).

Social, Green and Sustainability Financing Framework

DISCLAIMER – IMPORTANT

Please note that whilst the sustainability financing tranche of notes seek to comply with the International Capital Market Association (ICMA) Green Bond Principles, ICMA Social Bond Principles and ICMA Sustainability Bond Guidelines, where relevant, they may not be a suitable investment for all investors seeking exposure to green, social or sustainability assets. No assurance or representation is given as to the suitability or reliability for any purpose whatsoever of any opinion or certification of any external party. Please refer to the Information Memorandum of each issuance for details.

The HKMC implemented its Social, Green and Sustainability Financing Framework (link to the Framework) to expand and implement its sustainability strategy as an integral part of its business strategy.

Our ILBS contains a sustainability financing tranche, where its proceeds would be allocated to the purchase of eligible loans under the Framework.

For each ILBS, the HKMC will appoint sustainable finance opinion providers to provide an impact assessment report and a second party opinion.

The Framework has been developed in alignment with the following sustainable finance principles and guidelines:

ICMA Green Bond Principles 2025

ICMA Social Bond Principles 2025

ICMA Sustainability Bond Guidelines 2021

Grievance Mechanism

The IFS is committed to minimising Environmental and Social (E&S) risks by constantly monitoring our portfolio’s compliance with our Environmental and Social Guidelines. To this end, the Grievance Mechanism is designed as a transparent process to increase IFS’s accountability in projects it financed, by examining and responding promptly to the potential adverse impact on communities or the environment.

Grievance Mechanism

Any submissions may be directed to:

Address: Level 65, International Commerce Centre, 1 Austin Road West, Kowloon, Hong Kong

Email: [email protected]

Latest News

To be updated

Last Update Date:17/10/2025

For general inquiry, please direct to:

Address: Level 65, International Commerce Centre, 1 Austin Road West, Kowloon, Hong Kong

Email: [email protected]