The Hong Kong Mortgage Corporation Limited

Bauhinia ILBS 1

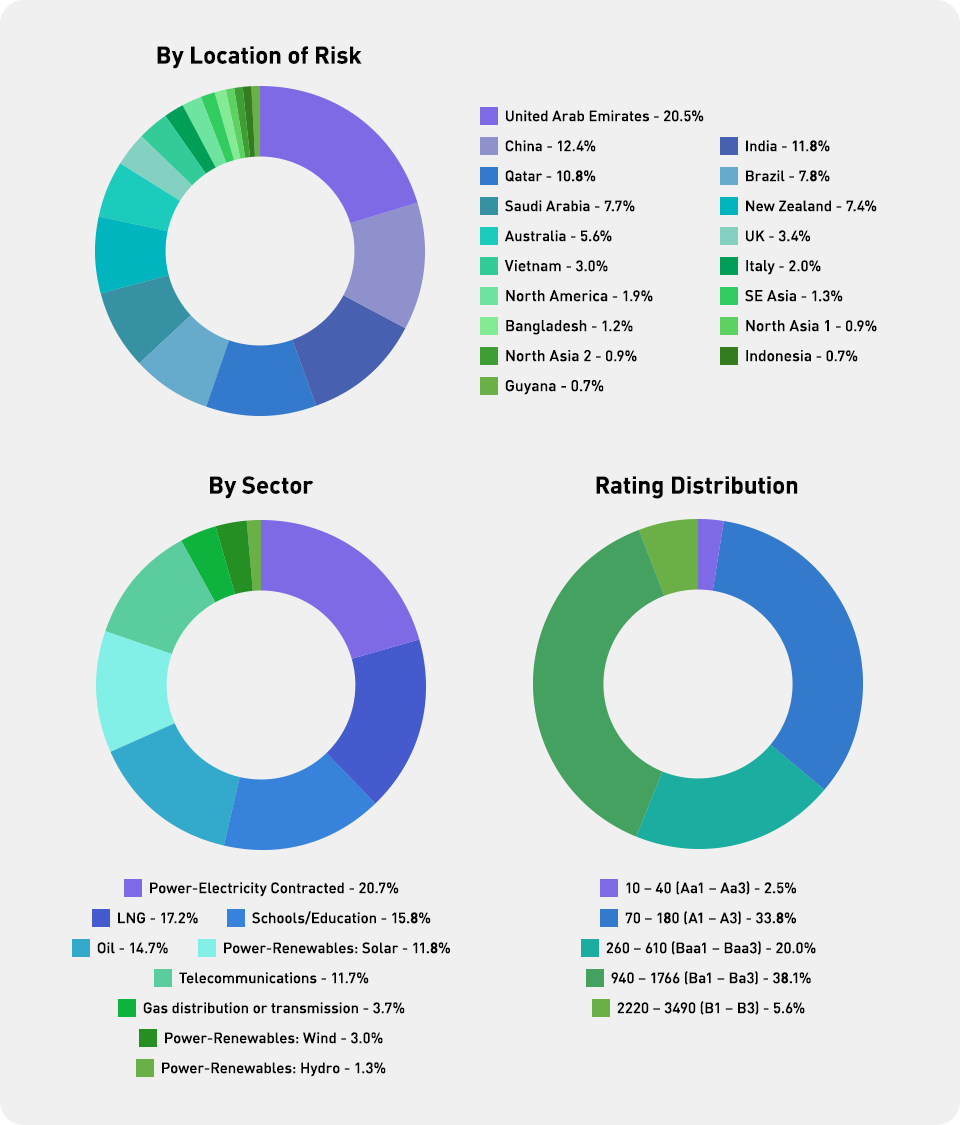

Bauhinia ILBS 1 Limited acquired a diversified portfolio of project and infrastructure loans across multiple geographies and sectors from the HKMC for an aggregate purchase consideration of US$404.8 million. The Portfolio is diversified across 25 projects among 9 sub-sectors as at the date of the Information Memorandum. The projects underlying the Portfolio are located in 12 countries across the Asia-Pacific, Middle East and the South America regions. The Portfolio has been assembled with a focus on availability-based infrastructure assets in the conventional power and water and social subsectors.

Formal |

Information |

Second |

Update to Second Party Opinion |

Impact |

E&S Impact Indicators |

Quarterly and Payment Date Reports

Sep 2023 |

Dec 2023 |

Mar 2024 |

Jun 2024 |

Sep 2024 |

Dec 2024 |

Mar 2025 |

Jun 2025 |

Sep 2025 |

Dec 2025 |

Audited Financial Statements

FY 2023 |

FY 2024 |

Moody's Rating Reports

May 2023 |

May 2023 Rating Action |

Mar 2024 Announcement |

Apr 2024 Rating Action |

Jan 2025 Announcement |

Mar 2025 Rating Action |

Dec 2025 Rating Action |

Capital Structure

| Class | Rating (Moody's)1 | Principal Amount (USD million) | Spread2 | Legal Maturity Date | |

| A1-SU | Aaa (sf) | 100.00 | 1.60% | 19 October 2044 | |

| A1 | Aaa (sf) | 199.60 | 1.70% | 19 October 2044 | |

| B | Aa1 (sf) | 36.50 | 2.50% | 19 October 2044 | |

| C | A2 (sf) | 18.25 | 3.95% | 19 October 2044 | |

| D | Baa3 (sf) | 10.00 | 5.95% | 19 October 2044 | |

| Subordinated Notes | Not rated | 40.43 | 6.00% | 19 October 2044 | |

1 Original rating at date of closing.

2 Spread is applied over 6-month Term SOFR

Portfolio Overview

Documents

Sponsor and Collateral Manager |

|

Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers | ||

|  |  |

Co-Manager |

|

Transaction Administrator, Trustee, Account Bank, Calculation Agent, Principal Paying Agent, Registrar and Transfer Agent | Legal Advisers | |

|  |  |

Sustainable Finance | Pre-issuance Sustainability | Rating Agency | Corporate Service Provider |

|  | Moody's Investors |  |

Last Update Date: 21/01/2026