The Hong Kong Mortgage Corporation Limited

Infrastructure Financing and Securitisation

The HKMC strives to develop financial products to fulfil its mandates, fill the market gaps and foster market development. The HKMC started in 2019 to implement the Infrastructure Financing and Securitisation (IFS) business, with the aim to:

- contribute to its mandate of developing the Hong Kong debt market via the issuance of marketable debt securities through securitisation of infrastructure debt;

- fill the infrastructure financing market gap at commercially viable and financially sustainable terms; and

- help consolidate Hong Kong’s position as an infrastructure financing hub and to benefit the financial and professional service sectors.

IFS acquires infrastructure loans from commercial banks on a primary and secondary basis, as well as co-finances infrastructure projects with multilateral development banks (MDBs) and commercial banks. The loan acquisition scope covers senior debt from greenfield and brownfield projects, including but not limited to conventional infrastructures such as power (conventional and renewable), electricity distribution / transmission, social infrastructure, telecommunication, transportation, and water desalination across the globe.

To further its mandate in developing local debt capital market and fostering the securitisation market development, the IFS implements the securitisation of infrastructure loan assets with a long-term goal to promote Infrastructure Loan Backed Securities (ILBS) as a standalone alternative asset class.

Infrastructure Loan Backed Securities (ILBS)

The ILBS, as an emerging asset class, aims to provide investors with exposure to a diversified portfolio of infrastructure loans across multiple geographies and sectors through publicly-rated infrastructure-related debt securities.

Governance

The IFS Investment Committee (IFSIC) is the governing forum to manage the infrastructure investments. It is chaired by the Executive Director of the HKMC. Voting members include the Chairman, Chief Executive Officer of the HKMC Group, Chief Investment Officer (Infrastructure Financing and Securitisation), Senior Vice Presidents and General Counsel from the Management Team.

The IFS Leadership Team manages the day-to-day execution of IFS business.

.png)

Risk management

Apart from corporate governance and risk management framework of the HKMC, the HKMC operates on prudent commercial principles and robust risk management policies consistent with common market practices, based on the principle of “prudence before profitability”. The IFS Risk Management Guidelines is implemented to consider and control the key risks, such as credit risk, asset-liability mismatch risk, environmental and social risk, and compliance risk, throughout the investment process.

.png)

To effectively manage the credit risk associated with the infrastructure loan investments, IFS business has developed prudent underwriting criteria and perform in-depth due diligence in-house with the assistance from independent consultants. All infrastructure investments have taken into consideration appropriate risks and returns, acceptable project risks and mitigation measures, and are also subject to ongoing monitoring and review. An internal credit rating methodology and a loss given default methodology (both developed by an external rating agency) are adopted to evaluate expected losses arising from infrastructure loan default.

Environmental, Social and Governance (ESG) Standards

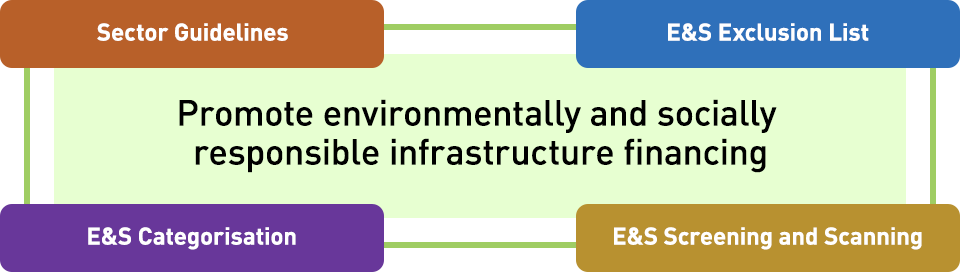

IFS Environmental and Social (E&S) Guidelines outlines the detailed risk management requirements and processes with respect to E&S related risks:

| 1 | Promote environmentally and socially responsible infrastructure financing | 2 | Establish a structured approach to monitor and record borrowers’ performances |

| 3 | Set out internal responsibilities and procedures on E&S due diligence for any potential investment on infrastructure loan assets | 4 | Ensure that the E&S risks management processes of the IFS business is aligned with industry practices and those adopted by other market players |

Sector Guidelines:

| Environmental and Social (E&S) Exclusion List:

|

E&S Categorisation:

| E&S Screening and Scanning:

|

The E&S Guidelines reflects international and local Hong Kong E&S standards, including among others, the Equator Principles adopted by project finance banks to assess and manage E&S risks in the projects. For transactions that are co-financed with Multilateral Development Banks, IFS also leverages on the safeguards adopted by these institutions to ensure rigor in the process. IFS carries out a risk-based general review based on best available information for transactions where the Equator Principles are not applicable, which may cover E&S Management System, E&S compliance and liabilities, and labour standards.

Governance risks associated with the borrowers and the projects are assessed and managed by the Compliance Guidelines, which seeks to:

- ensure that due diligence has been conducted to consider and identify compliance risks and impacts related to the projects;

- formulate approaches to manage and mitigate the potential compliance risks;

- work with borrowers to continuously seek improvement on managing the governance risks, to the extent practicable; and

- monitor the implementation of the project and identify any potential changes to the governance related risks and impacts post-commitment.

MoU banks

To promote infrastructure financing, the HKMC has entered into Master Cooperation Agreement with IFC, as well as memorandum of understanding (MoU)s with China Export & Credit Insurance Corporation and 20 commercial banks to strengthen its network and business operation.

.png)

Milestones

2017

- Started to study the IFS business opportunities

- Engaged an international reputable financial institution for an expert advisory service in relation to the business

2018

- Finalised the IFS business plan and obtained the Board of Director’s approval

- Set up the IFS Division manned with experienced industry professionals

2019

- Commenced the implementation of the IFS business

- Executed Master Cooperation Agreement with International Finance Corporation

- Signed a Memorandum of Understanding with China Export & Credit Insurance Corporation (Sinosure) on infrastructure financing co-operation

2021

- Signed a Memorandum of Understanding (MoU) with MUFG Bank, Ltd. on Infrastructure Loan Sales Framework

- Signed MoUs with 5 partner banks, Crédit Agricole Corporate and Investment Bank, HSBC, ING Bank, Natixis S.A., and Standard Chartered Bank, on Infrastructure Loans Framework

2022

- Signed MoUs with additional 15 partner banks on Infrastructure Loan Framework

- Commenced the Pilot Infrastructure Loan-Backed Securitisation process

2023

- Issued the Pilot Infrastructure Loan-Backed Securities via Bauhinia ILBS 1 Limited

- Received the Finance Asia Achievement Awards 2023 – Best Bond Deal, Best Infrastructure Deal, and Best Structure Finance Deal (Hong Kong SAR)

- Received the IFR Asia Awards 2023 – Asia-Pacific Structured Finance Issue

- Received from the HKQAA the following awards:

- Outstanding Award for Green and Sustainable Bond Issuer (Infrastructure Financing and Securitisation) – Largest Single Sustainability Bond

- Outstanding Award for Green and Sustainable Bond Issuer (Public Sector Entity) - Largest Amount of Social Bonds

2024

- Received The Asset Triple A Awards 2024 - Most Innovative Deal of the Year for its Bauhinia ILBS 1

- Issued the second Infrastructure Loan-Backed Securities via Bauhinia ILBS 2 Limited