The Hong Kong Mortgage Corporation Limited

Bauhinia ILBS 3

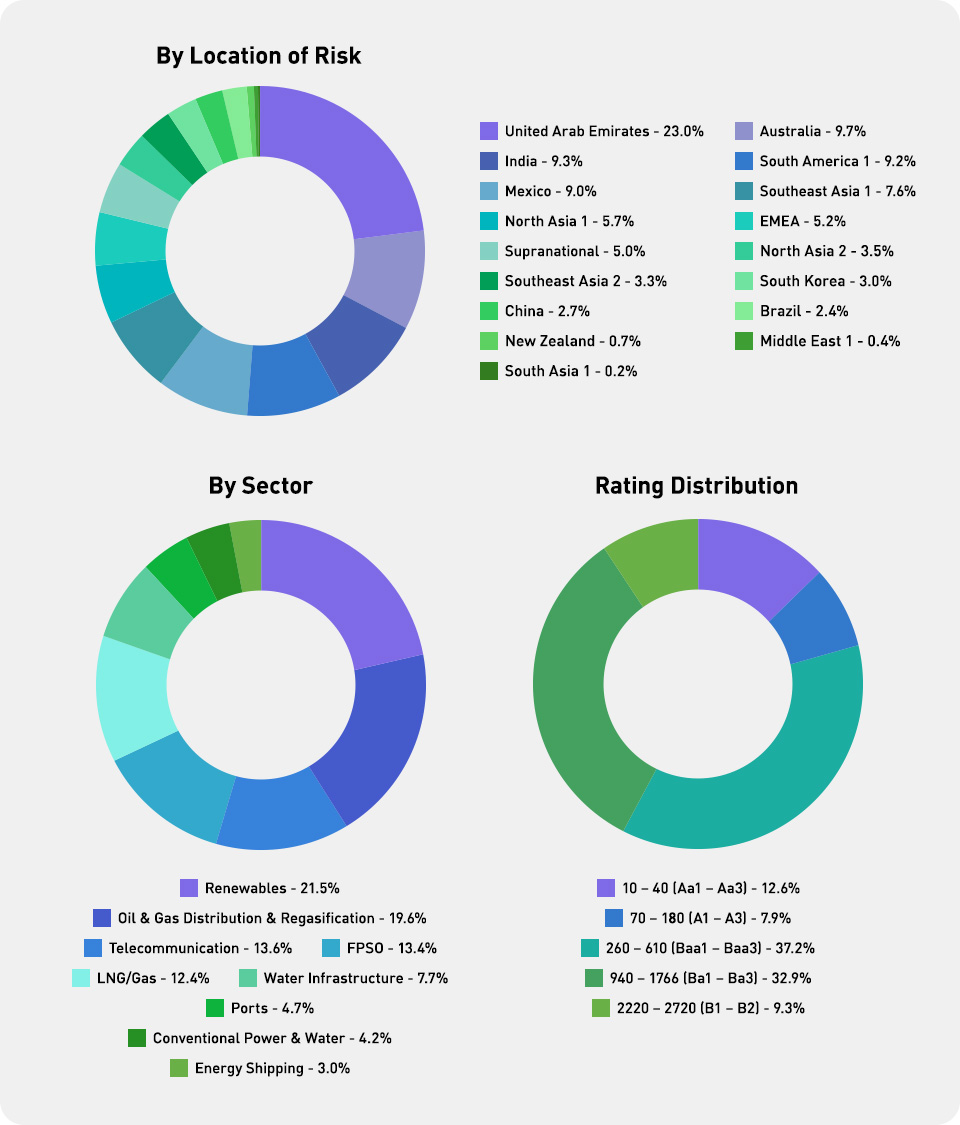

Bauhinia ILBS 3 Limited acquired a diversified portfolio of infrastructure loans and other financial assets across multiple geographies and sectors from the HKMC for an aggregate purchase consideration of US$450.5 million. The Portfolio is diversified across 28 projects among 9 sub-sectors as at the date of the Information Memorandum. The projects underlying the Portfolio are located in 12 countries across the Asia-Pacific, Europe, Middle East, North and South America regions. The Portfolio predominantly includes water, telecommunication, natural resources, energy and power generation infrastructure assets.

Formal |

Information |

Second |

Impact |

Quarterly and Payment Date Reports

|

Moody's Rating Reports

|

Oct 2025 |

Capital Structure

| Class | Rating (Moody's)1 | Principal Amount (USD million) | Spread2 | Legal Maturity Date | |

| A1-SU | Aaa (sf) | 117.00 | 1.29% | 19 October 2045 | |

| A1 | Aaa (sf) | 229.90 | 1.30% | 19 October 2045 | |

| B | Aa1 (sf) | 32.00 | 1.65% | 19 October 2045 | |

| C | A3 (sf) | 33.00 | 1.95% | 19 October 2045 | |

| D | Ba1 (sf) | 16.00 | 5.00% | 19 October 2045 | |

| Subordinated Notes | Not rated | 22.59 | 7.20% | 19 October 2045 | |

1 Original rating at date of closing.

2 Spread is applied over daily non-cumulative compounded SOFR, for interest payable every 6-month period

Portfolio Overview

Documents

Sponsor and Collateral Manager |

|

Sole Global Coordinator and Joint Bookrunner |

|

Joint Bookrunners | |||

|  |  |  |

Co-Manager | |

|

Transaction Administrator, Account Bank, Custodian, Calculation Agent, Principal Paying Agent, Registrar, Transfer Agent and Trustee | |

|

Legal Advisers | ||

|  |  |

Pre-issuance Sustainable Finance Second Party | Pre-issuance Sustainability | Rating Agency | Corporate Service Providers |

|  | Moody's Investors |  |

Last Update Date: 21/01/2026